At this time last year, analysis of the North American climbing gym industry revealed an array of somewhat contrasting trends; commercial gym development was booming, whereas operators of preexisting climbing gyms—that is, gyms that were already in operation when the year began—were citing significant headwinds. This year, as we reflect on the trends of 2025, we can say that the overall trends were more aligned and many key indicators trended downward.

Specifically, the number of new climbing gyms that opened in North America was down for 2025 compared to 2024, and so too was the total amount of climbing wall surface built across those new gyms. And based on the results of CBJ’s first Gyms & Trends Survey, traffic and revenues were largely flat or down at many preexisting gyms around the continent. Adding to these hurdles, and perhaps playing a major role in consumer habits throughout 2025, was an uptick in expenses and general macroeconomic woes referenced in the survey responses—all of which prompted some gyms to scale back their plans for growth and expansion.

In short, it’s safe to say 2025 was a challenging year for the climbing gym industry in North America. “Boom times are over,” summed up one operator at a multi-location climbing gym business. “Profitability is much harder unless you have scale and infrastructure to support institutional growth or mergers and acquisitions.”

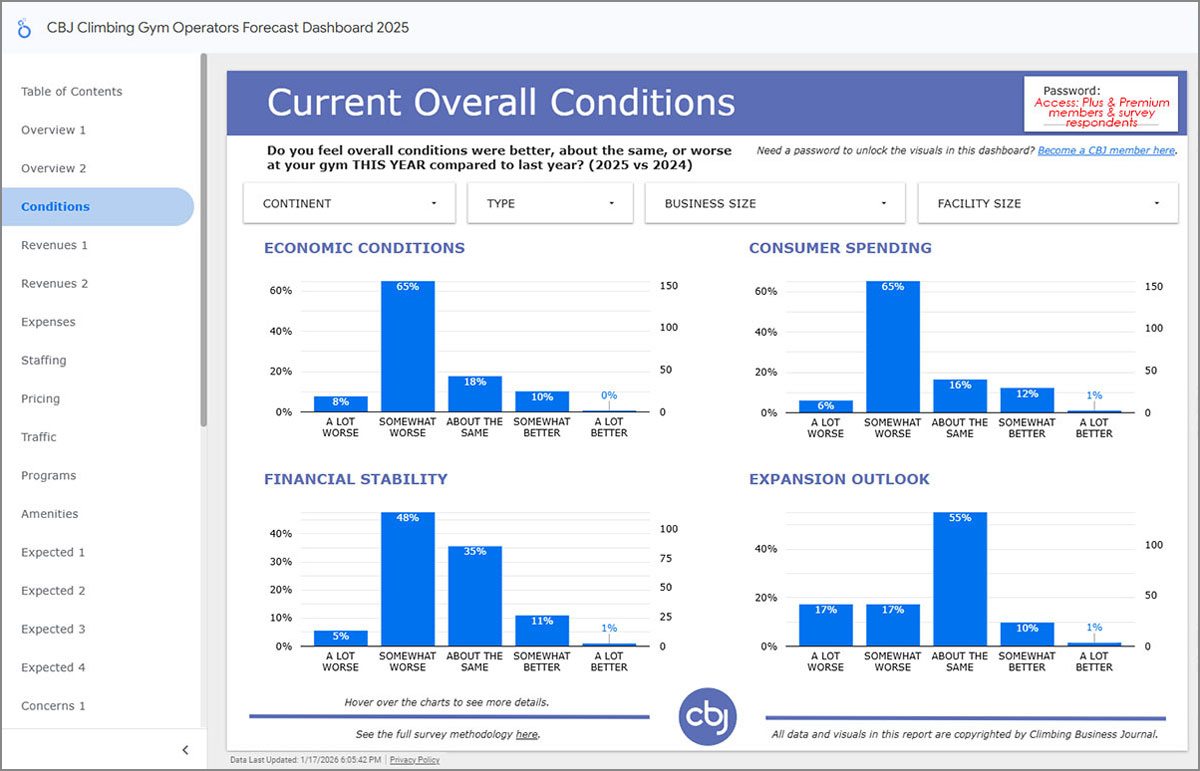

That assessment echoed many others expressed via CBJ’s Gyms & Trend Survey—more of which will be featured throughout this report. We also highlight key statistical takeaways from the survey results, which span 240 climbing facilities (85% United States, 8% Canada, 3% Mexico, 4% other countries) and can be viewed in full in the CBJ Climbing Gym Operators Forecast Dashboard. The interactive dashboard displays in-depth trends from 2025 in climbing facility revenues, expenses, traffic, prices, programs, amenities and more, as well as expected trends for 2026.

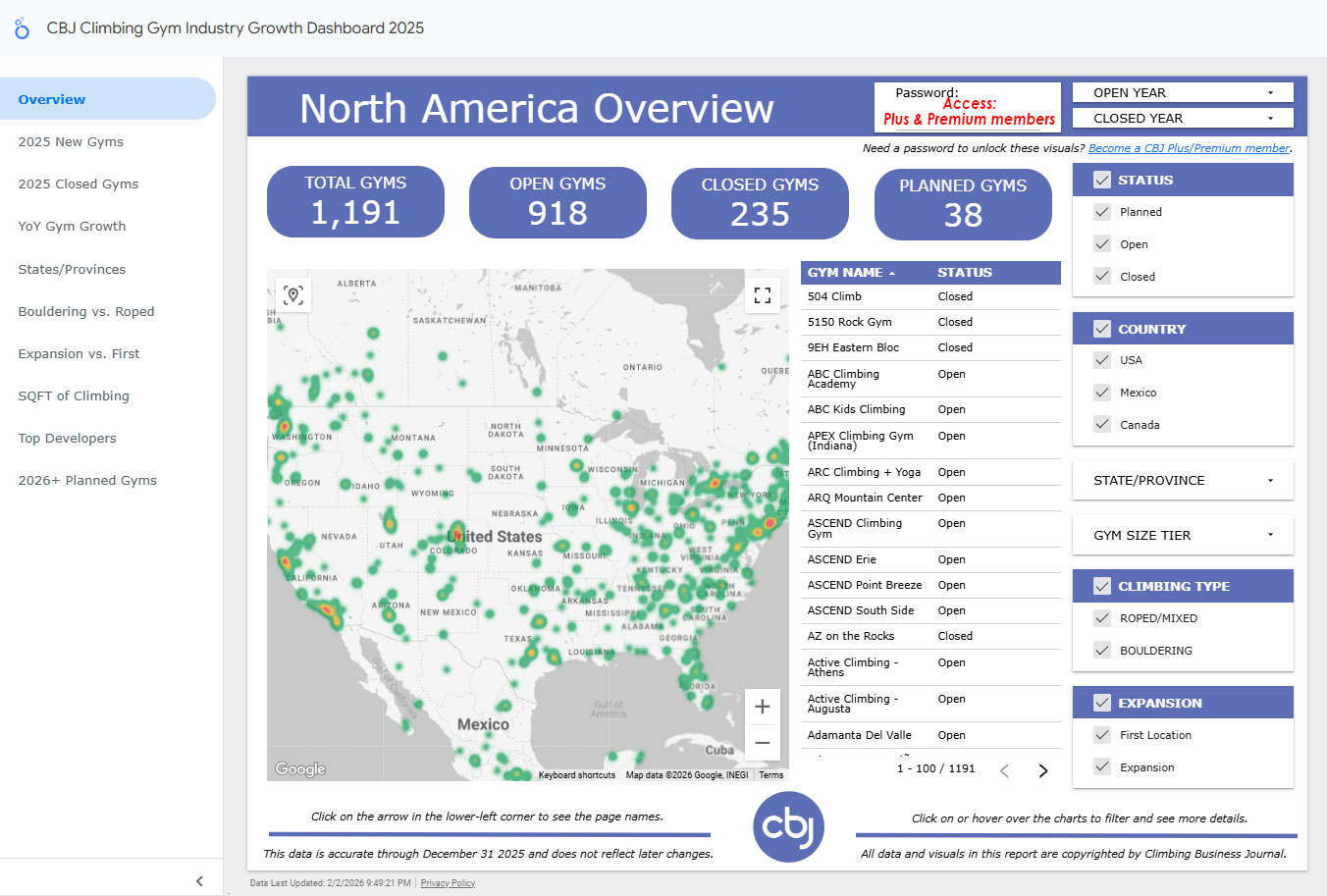

While feelings of “uncertainty” and “concern” underscore much of this year’s analysis, there were also some bright spots that shone through the data, including a rise in youth program sign-ups that buoyed some gyms last year. Read on for more high-level takeaways from the survey results, and more statistics on new climbing gym development in North America can be found at the end of this report and in the CBJ Climbing Gym Industry Growth Dashboard.

In tandem with this report and the accompanying dashboards, be sure to check out the 2025 CBJ Gym List Awards, which lists all the new climbing gym openings and closures in North America last year, as well as the leading gyms and suppliers.

Key Statistics on North American Climbing Gym Growth in 2025

53 newly opened climbing gyms (40 USA, 11 CAN, 2 MEX)

(60 in 2024: 48 USA, 7 CAN, 5 MEX)

12 permanent climbing gym closures (12 USA, 0 CAN, 0 MEX)

(8 in 2024: 7 USA, 1 CAN, 0 MEX)

41 net new climbing gyms (28 USA, 11 CAN, 2 MEX)

(52 in 2024; 41 USA, 6 CAN, 5 MEX)

4.7% net growth rate (4.2% USA, 6.5% CAN, 5.0% MEX)

(6.3% in 2024; 6.5% USA, 3.7% CAN, 14.3% MEX)

356,314 square feet of climbing across new gyms (307,832 USA, 41,562 CAN, 6,920 MEX)

(460,997 in 2024; 404,311 USA, 23,200 CAN, 33,486 MEX)

Access the Report & Dashboards

Want to access the report and dashboards?

- Took the survey? We sent you an email with information on accessing the results for FREE (please reach out here if not).

Missed last year’s survey? Keep an eye out for this year’s, so you can get free access to the results and help us make the sample size even more meaningful.

- CBJ member at any paid level? Just log in to view the report!

- CBJ member at the Plus or Premium level? You can also access the CBJ Climbing Gym Operators Forecast Dashboard here and CBJ Climbing Gym Industry Growth Dashboard here!

- Not yet a CBJ member? Don’t miss out! Learn more and enroll here. Every paid level is packed with valuable benefits starting at $150/year.

To keep reading, login or become a CBJ member...

Unlock this and many more CBJ resources!

Already a member? Login below.