As we all know, the pandemic had an unprecedented impact on the climbing industry. While we’ve seen climbers return to the gym, for many who are still recovering financially, a little extra cash goes a long way.

To support the industry, Rock Gym Pro continues to explore ways to add value for climbing gyms beyond the use of our software.

Today, we’re excited to introduce our partnership with LG Resources.

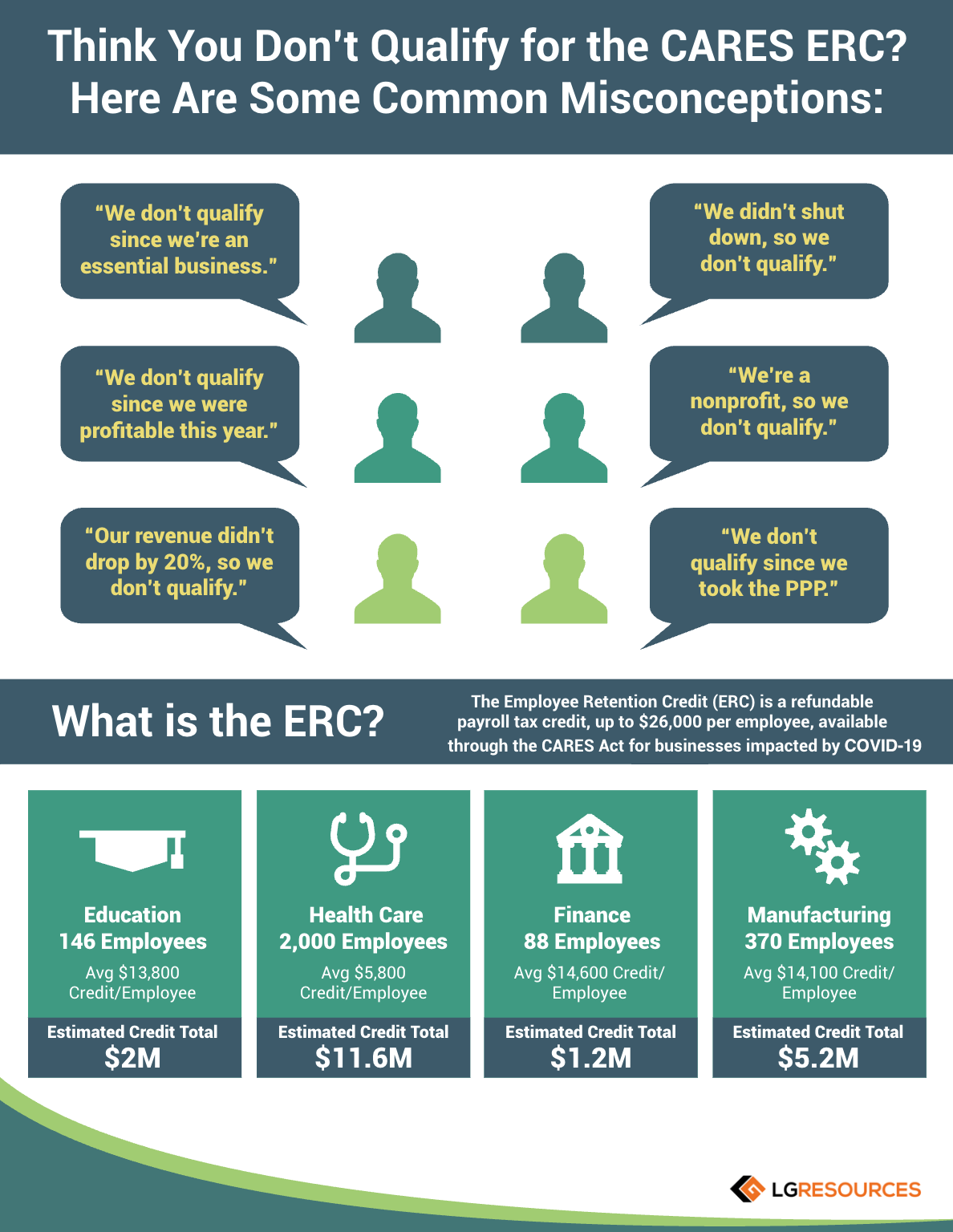

LG Resources works with thousands of businesses each year to help maximize the financial benefit received from the Employee Retention Credit (ERC). To date, they have secured over $1.3 billion through this program.

The ERC is a refundable payroll tax credit available through the CARES Act for U.S. businesses impacted by COVID-19. Qualified businesses are eligible to receive up to $26,000 per employee. If your business was fully or partially suspended by government orders or experienced a reduction in year-over-year gross recipients of 50% in 2020 or 20% in 2022, you may qualify.

Even if you’ve received a PPP loan, you may still be eligible.

Case Study #1:

A gym took both rounds of PPL loans and still qualified for ERC due to a shutdown in 2020 and 2 quarters in 2021.

- 15 Full-time Employees

- ERC Claim = $165,000

Case Study #2:

A gym took both rounds of PPL loans while shut down in 2020 and 1 quarter in 2021.

- 11 Full-time Employees

- ERC Claim = $83,000

How Does it Work?

The process to secure this payroll tax credit is simple.

- Schedule a complimentary consultation with LG Resources to see if you qualify.

- LG will determine your eligibility based on the IRS guidelines to claim the credit and will calculate the proposed credit that you receive.

- LG will file an amended 941X to help you claim the ERC from 2020 and 2021.

Who among us couldn’t use some extra cash?

Find out if you qualify today by booking your complimentary consultation.

> More Information on the ERC Tax Credit

CBJ press releases are written by the sponsor and do not represent the views of the Climbing Business Journal editorial team.